UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

| Filed by the Registrant | Filed by a Party other than the Registrant | |

| Check the appropriate box: | ||

Invesco Ltd.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than Registrant)

Payment of Filing Fee (Check the appropriate box):

| No fee required. |

| Fee computed below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11. (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| Fee paid previously with preliminary materials. |

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

| A Letter to Our Shareholders from the Chairperson of Our Board | ||

Dear Fellow Invesco Shareholder: | ||

| Our multi-year strategic objectives help us deliver strong outcomes for clients and shareholders. For more information, seeOur multi-year strategic objectives and annual operating plan beginning on page 27. | It has been my great honor to serve on the Board of Directors of Invesco since 2009 and as Chairperson since 2014. All members of the Board are very aware that we are here because you have entrusted us to be stewards of your investment. We are committed to maintaining a client-focused culture and aligning the firm’s highly talented people with our multi-year strategic objectives, which enables Invesco to deliver strong, long-term investment performance to clients and further advance our competitive position. We believe firmly that if we help clients achieve their investment objectives and manage our business effectively and efficiently, we can continue to deliver strong results to shareholders over the long term. The Board takes seriously our duties and responsibilities. Set forth below are a few of the many areas in which the Board focused its attention in 2016. | |

| We are committed to strong governance. For more information regarding our corporate governance practices, seeCorporate Governance beginning on page 12. | Board Composition and Effectiveness. Shareholders are rightly interested in the composition and effectiveness of the Board. The Board remains committed to ensuring that it is composed of a highly capable group of directors who are well-equipped to oversee the success of the company and effectively represent the interests of shareholders. Providing our Board with the appropriate balance of expertise, experience, continuity, as well as new perspectives is an important component to a well-functioning board. The company’s “diversity of thought” of its employees, which is embraced by the Board as well, is an essential element of Invesco’s culture and helps us manage the company for the benefit of clients and shareholders over the long term. We encourage you to review the qualifications, skills and experience that we have identified as important attributes for directors of our company and how they match up to each of our directors. It has always been the aim of the Board to operate in the most effective and efficient manner possible. Therefore, each year the Board, with the assistance of an external advisor specializing in corporate governance, conducts an evaluation of the performance of our Board and each of its committees. Directors participate inone-on-one interviews with the advisor, receivein-person feedback from the advisor based on confidential and private interviews, and determine if the Board needs to modify its activities to enhance further the operations of the Board and its committees. In addition to the interviews of each director, interviews are also conducted with those members of senior management who work with and observe the operation of the Board on a regular basis. | |

| We are committed to shareholder engagement and encourage an open dialogue. For more information on how to communicate with our Board, seeImportant Additional Information beginning on page 73. | Shareholder Outreach and Our Proxy Access Proposal. As we conduct the activities of the Board, a key priority is ensuring robust outreach and engagement with you, the owners of the company. Partnering with management, we receive feedback from shareholders throughout the year on a variety of topics, including governance and executive compensation. We listen and carefully consider your perspectives in our decision-making process and make enhancements to our governance and executive compensation programs, including those described herein, based on your input. Your Board has unanimously adopted and is submitting to you for approval amendments to ourbye-laws that would implement “proxy access” – facilitating eligible shareholders to include their director nominees in the company’s proxy materials for an annual general meeting of shareholders, along with candidates nominated by the Board. The Board is committed to considering the views of our shareholders and believes our Proxy Access provisions provide meaningful rights to our long-term shareholders. Please see Proposal 4 in our Proxy Statement for a further description of Proxy Access. We encourage you to vote in favor of the proposal. |

| Our compensation programs are structured to align rewards with long-term client and shareholder success.For more information regarding our executive compensation programs, seeCompensation Discussion and Analysisbeginning on page 24. | Compensation.To support our multi-year strategic objectives, the Board’s compensation committee has structured our compensation programs for our executives, investment professionals and other employees to align individual rewards with client and shareholder success. Our engagement with shareholders in the fall and winter of 2016 reaffirmed our belief that our compensation programs are sound and appropriately aligned with the long- term interests of our clients and shareholders. Furthermore, our shareholders positively acknowledged our recent enhancements to our compensation programs that more effectively link the programs with the company’s progress against its strategic objectives, annual operating plan and long-term shareholder value creation. For example, we recently transitioned the performance period for our long-term, performance-based equity awards from aone-year to a three-year performance period, and such awards are subject to more rigorous vesting thresholds. | |

Communication with the Board.The Board is committed to continuing to engage with shareholders and encourages an open dialogue. Please continue to share your thoughts with us on any topic as we value your input, investment and support. The Board has established a process to facilitate communication by shareholders with Board members. Communications can be addressed to the Board of Directors in care of the Office of the Company Secretary, Invesco Ltd., 1555 Peachtree Street NE, Atlanta, Georgia 30309 or bye-mail to company. secretary@invesco.com. | ||

| Proxy statement summary For a convenient overview of the matters to be voted on at our Annual General Meeting, seeProxy Statement Summarybeginning on page 1. | Annual General Meeting Invitation. You are cordially invited to attend the 2017 Annual General Meeting of Shareholders of Invesco Ltd., which will be held on Thursday, May 11, 2017, at 1:00 p.m., Central Time, at the Langham Hotel, located at 330 N. Wabash Avenue, Chicago, Illinois 60611. | |

Your vote is important and we encourage you to vote promptly. Whether or not you are able to attend the meeting in person, please follow the instructions contained in the Notice of Internet Availability of Proxy Materials (“Notice”) on how to vote via the Internet or via the toll-free telephone number, or request a paper proxy card to complete, sign and return by mail so that your shares may be voted. | ||

On behalf of the Board of Directors, I extend our appreciation for your continued support. | ||

Yours sincerely, | ||

Ben F. Johnson III | ||

| Chairperson |

Notice of 2017 Annual General Meeting of Shareholders To Our Shareholders: The 2017 Annual General Meeting of Shareholders of Invesco Ltd. will be held at the following location and

|  | |||||||

Your vote is important

Please vote by using the internet, the telephone or by

signing, dating and returning the enclosed proxy card

March 31, 2014

Invesco Ltd.

Two Peachtree Pointe

1555 Peachtree Street N.E.

Atlanta, Georgia 30309

Dear Fellow Shareholder,

You are cordially invited to attend the 2014 Annual General Meeting of Shareholders of Invesco Ltd., which will be held on Thursday, May 15, 2014 at 1:00 p.m., Eastern Time, in the Appalachians Room, 18th Floor, at Invesco’s Global Headquarters, located at Two Peachtree Pointe, 1555 Peachtree Street N.E., Atlanta, Georgia 30309. Details of the business to be presented at the meeting can be found in the accompanying Notice of 2014 Annual General Meeting of Shareholders.

We are pleased to once again this year furnish proxy materials to our shareholders via the Internet. Thee-proxy process expedites shareholders’ receipt of proxy materials and lowers the costs and reduces the environmental impact of our Annual General Meeting. On March 31, 2014, we mailed to our shareholders a Notice of Internet Availability of Proxy Materials (“Notice”). The Notice contained instructions on how to access our 2014 Proxy Statement, Annual Report on Form 10-K and other soliciting materials and how to vote. The Notice also contains instructions on how you can request a paper copy of the Proxy Statement and Annual Report if you so desire.

We hope you are planning to attend the meeting.Your vote is important and we encourage you to vote promptly. Whether or not you are able to attend the meeting in person, please follow the instructions contained in the Notice on how to vote via the Internet or via the toll-free telephone number, or request a paper proxy card to complete, sign and return by mail so that your shares may be voted.

On behalf of the Board of Directors and the management of Invesco, I extend our appreciation for your continued support. for the following purpose:

|

|

|

| |||||

NOTICE OF 2014 ANNUAL GENERAL MEETING OF SHAREHOLDERS

Thursday, May 15, 2014

1:00 p.m.

The Annual General Meeting of Shareholders of Invesco Ltd. will be held at Invesco’s Global Headquarters in the Appalachians Room, 18th Floor, located at Two Peachtree Pointe, 1555 Peachtree Street N.E., Atlanta, Georgia 30309 on Thursday, May 15, 2014 at 1:00 p.m. local time. The purposes of the meeting are:Thursday, May 11, 2017, at 1:00 p.m., Central Time

| Where | Langham Hotel Melbourne Room 330 N. Wabash Avenue Chicago, Illinois 60611 | |||||

To elect | |||||

To hold an advisory vote to approve the company’s executive compensation; | ||||||

| 3 | To hold an advisory vote on the frequency of holding future advisory votes on the company’s executive compensation; | |||||

To amend the Invesco Ltd. Second Amended and RestatedBye-Laws to implement proxy access and other matters; | ||||||

| 5 | To appoint PricewaterhouseCoopers LLP as the company’s independent registered public accounting firm for the fiscal year ending December 31, | |||||

To consider and act upon such other business as may properly come before the meeting or any adjournment thereof. | ||||||

During the Annual General Meeting, the audited consolidated financial statements for the fiscal year ended December 31, 2016 of the company will be presented. | ||||||

Who can vote | Only holders of record of Invesco Ltd. common shares on March 13, 2017 are entitled to notice of and to attend and vote at the Annual General Meeting and any adjournment or postponement thereof. | |||||

During the Annual General Meeting, the audited consolidated financial statements for the fiscal year ended December 31, 2013 of Invesco will be presented. Only holders of record of Invesco common shares on March 17, 2014 are entitled to notice of and to attend and vote at the Annual General Meeting and any adjournment or postponement thereof.

March 31, 2014

Atlanta, Georgia

By Order of the Board of Directors,

Kevin M. Carome, Company Secretary

Review your Proxy Statement and vote in one of four ways: | ||||||

|

Visit the web site listed on your |   |

Sign, date and return a requested proxy card | |||

|

Call the telephone number listed on your |

|

Attend the Annual General Meeting in | |||

By Order of the Board of Directors, | ||||||

Kevin M. Carome Company Secretary March [24], 2017 | ||||||

i

Our 2016 highlights | ||||||||||||||

| In spite of challenging market conditions, Invesco continued to execute well against our strategic objectives described below, which enabled us to deliver strong, long-term investment performance to clients and further advance our competitive position. At the same time, our financial performance for 2016 was lower year-over-year, reflecting volatile markets, numerous headwinds in the operating environment of many markets we serve and efforts to invest in our business for the long term. After a review of the company’s financial performance, our Compensation Committee decided that the company-wide incentive pool should be reduced for 2016. In addition, as part of its rigorous and judicious executive compensation decision-making, our Compensation Committee determined that our chief executive officer’s total incentive compensation should be reduced by approximately 11%. | ||||||||||||||

| ||||||||||||||

2016 Financial performance (year-over-year change)

| ||||||||||||||

Annual Adjusted Operating Income1 |

Annual Adjusted Operating Margin1 |

Annual Adjusted Diluted EPS1 |

Return of Capital to Shareholders2 |

Long-Term Organic Growth Rate3 | ||||||||||

$1.3 Billion |

38.7% |

$2.23 |

$995 Million |

1.9% | ||||||||||

| (-12.1%) | (-2.3 percentage points) | (-8.6%) | (-0.8%) | (-0.5 percentage points) | ||||||||||

1 The adjusted financial measures are allnon-GAAP financial measures. See the information in Appendix B of this Proxy Statement regarding Non- GAAP financial measures. 2 Return of capital to shareholders is calculated as dividends paid plus share repurchases during the year ended December 31, 2016. 3 Annualized long-term organic growth rate is calculated using long-term net flows divided by opening long-term AUM for the period. Long-term AUM excludes institutional money market AUM and PowerShares QQQ AUM.

We continued to successfully execute our strategic objectives for the benefit of clients and shareholders We focus on four key strategic objectives set forth in the table below that are designed to maintain our focus on meeting client needs and strengthen our business over time for the benefit of shareholders. As described below, in 2016 we made significant progress against our strategic objectives and enhanced our ability to deliver strong outcomes to clients while further positioning the firm for long-term success.

| ||||||||||||||

| Our strategic objectives | 2016 Achievements – A strong focus on delivering better outcomes to clients | |||||||||||||

Achieve strong investment performance |

Percent of our actively managed assets in the top half of our peer group. See Appendix A for important disclosures regarding AUM ranking.

| |||||||||||||

– Further strengthened our investment culture, which enabled us to deliver strong, long-term investment performance to our clients across the globe, in spite of volatile markets. | ||||||||||||||

Be instrumental to our clients’ success |

– Continued to expand our solutions team, which brings together the full capabilities of the firm to provide outcomes that help clients achieve their investment objectives. A key result of this strategy was winning the Rhode Island 529 mandate of $6.5 billion AUM. | |||||||||||||

– Successfully launched our global key account initiative and further coordinated client engagement across regions to enhance our clients’ investment experience. | ||||||||||||||

– Invested in our institutional business by further refining our global strategy, strengthening the team with experienced talent and more effectively aligning the firm’s efforts to opportunities in the market. We saw early successes from this work, with strong institutional flows in the third and fourth quarters of 2016. | ||||||||||||||

Harness the power of our global platform |

– Completed the acquisition of Jemstep, a market-leading provider of advisor-focused digital solutions. The acquisition represents an investment in our partnership with the advisor community and highlights our efforts to participate in the technology evolution within our industry. | |||||||||||||

– Enhanced our social responsibility efforts by publicly communicating our perspective on environmental, social and governance issues; published our first Global Investment Stewardship Report in early 2017. | ||||||||||||||

Perpetuate a high-performance organization |

– Further strengthened our investment and distribution teams through new hires and our efforts to attract, develop, motivate and retain the best talent in the industry. | |||||||||||||

– Initiated our business optimization program, which delivered more than $20 million in annualizedrun-rate expense savings in its first year. | ||||||||||||||

1

This summary highlights selected information in this Proxy Statement. Please review the entire Proxy Statement and the company’s Annual Report on Form 10-K for the year ended December 31, 2013 before voting.

2013 Performance Highlights

Enhancements to our executive compensation program At the 2016 Annual General Meeting of Shareholders, 79.7% of the votes cast were in favor of the advisory proposal to approve our named executive officer compensation. As described below, the committee made enhancements to the executive compensation program last year in response to shareholder feedback received in 2015 and early 2016 and the committee’s review of the compensation market. During the fall and winter of 2016, we again sought feedback on our compensation programs from our largest shareholders. The shareholders who recently provided feedback did not voice any concerns regarding our named executive officer compensation and positively acknowledged our recent changes. Based on these responses, no additional changes were made to our compensation program this year. | ||||||||||||||||

| Long-term performance-based equity awards granted in 2017 in respect of 2016 are subject to a multi-year performance period. Based on feedback from shareholders, we have transitioned the performance period for our long-term performance-based equity awards from a1-year to a3-year performance period. The committee continues to believe a multi-year performance period, like the other performance-based award enhancements listed below, strengthens alignment of our executive officers’ compensation with client interests and shareholder success and is consistent with market best practice. | |||||||||||||||

| Long-term equity awards granted in 2017 in respect of 2016 vest subject to the achievement of adjusted operating margin, as opposed to achievement of either adjusted operating margin or adjusted earnings per share thresholds in prior years. A focus on adjusted operating margin ensures discipline in corporate investments, initiatives and capital allocation. It is a measure of overall strength of the business and, importantly, we believe it more effectively avoids conflicts of interest with clients than other measures could introduce. | |||||||||||||||

| Performance objectives are applied to performance-based awards granted in 2017 in respect of 2016. The committee made this enhancement last year in tandem with introducing a multi-year performance period to performance-based awards. We believe this further strengthens alignment of our executive officers’ compensation with client interests and shareholder success. SeeOur variable incentive compensation – Our long-term equity awards below for additional details. | |||||||||||||||

|

| |||||||||||||||

| ||||||||||||||||

|

| |||||||||||||||

*Note Regarding Non-GAAP Financial Measures: The adjusted financial measures are all non-GAAP financial measures. See the information on page 53 through 58 of our Annual Report on Form 10-K for the fiscal year 2013 for a presentation of, and reconciliation to, the most directly comparable GAAP measures. All current and prior period references to consolidated Invesco Ltd. results, including pre-cash bonus operating income (“PCBOI”) and assets under management (“AUM”), exclude the operations of the Atlantic Trust Private Wealth Management business (“Atlantic Trust”). The company closed the sale of Atlantic Trust on December 31, 2013.

2013 was a year of strong performance for Invesco. Invesco continued to provide strong, long-term investment performance to clients, which contributed to robust organic growth throughout the year. We delivered excellent results for our shareholders, continued to make progress against our strategic objectives and continued to expand the company’s investment capabilities globally.

2013 Executive Compensation Highlights

Our compensation programs are tied to the achievement of our financial and strategic results and our success in serving our clients’ and shareholders’ interests. Reflecting our strong financial results and significant achievements related to our long-term strategic objectives, the compensation of our executive officers was positively impacted in 2013 and paid from the aggregate pool approved by the Compensation Committee (see“Executive Compensation – Compensation Discussion and Analysis – Setting Annual Incentive Compensation Pool”). Below we highlight the results of the 2013 compensation decisions for our executive officers.

|

|

|

|

|

Proxy Statement Summary (cont’d)

Results of 2013 Say-on-Pay Vote and Our Investor Outreach

At the 2013 Annual General Meeting of Shareholders, 95.8% of the votes cast were in favor of the advisory proposal to approve our named executive officer (“NEO”) compensation, (the “Say-on-Pay” advisory proposal). Although we believe that the 2013 vote conveyed our shareholders’ strong support of the committee’s decisions and the existing executive compensation programs, during the balance of 2013 and early 2014, we continued to actively seek investor feedback concerning our compensation programs. In 2013 and early 2014, we held meetings with a significant number of our largest shareholders. While all of the shareholders we spoke with agree on the importance of pay and performance alignment, there was no consensus among these shareholders on how alignment should be measured. A number of the shareholders indicated that their Say-on-Pay decisions are made on a case-by-case basis and that they have not had any issues with Invesco’s compensation in prior years, some noting in particular that they believe appropriate decisions have been made for NEO compensation. Our largest shareholders do not share a consistent philosophy regarding the structure of compensation. That said, all shareholders affirmed the importance of clear disclosure and transparency regarding the decision making process undertaken by the committee. Based on this feedback the committee determined to continue our current compensation practices as described in this Compensation Discussion and Analysis.

Matters For Shareholder Voting

At this year’s Annual General Meeting, we are asking our shareholders to vote on the following matters:

|

The Board recommends a voteFOR this proposal. See further below in this summary and page 5 for details.

|

The Board recommends a voteFOR the election of the director nominees named in this Proxy Statement. See further below in this summary and pages 6 through 12 for further information on the nominees.

|

The Board recommends a voteFOR this proposal. See page 53 for details.

|

The Board recommends a voteFOR this proposal. See page 54 for details.

Amendment to Our Bye-Laws to Declassify Our Board Of Directors

Currently, our Board of Directors is divided into three classes and members of our Board are elected for staggered terms of three years. Our Board has adopted an amendment to the Invesco Ltd. Amended and Restated Bye-Laws (the “Bye-Laws”) that, if approved by the shareholders at this year’s Annual General Meeting, will provide for annual elections of our directors as follows. Commencing with the class of directors standing for election at the 2015 Annual General Meeting, directors will stand for election for one-year terms, expiring at the next succeeding Annual General Meeting. The directors who were elected at the 2013 Annual General Meeting, whose terms will expire in 2016, and the directors who are elected at the 2014 Annual General Meeting under Proposal No. 2, whose terms will expire in 2017, will continue to hold office until the end of the terms for which they were elected. Therefore, if this proposal is approved, all directors will be elected on an annual basis beginning with the 2017 Annual General Meeting. In all cases, each director will hold office until his or her successor has been elected and qualified or until the director’s earlier resignation or removal. If the amendment to the Bye-Laws is not approved by our shareholders, our Board will remain classified. This proposal requires the affirmative vote of at least 75% of the issued and outstanding shares of the company.

Proxy Statement Summary (cont’d)

Election Of Directors

You are being asked to cast votes for two directors, Messrs. Denis Kessler and G. Richard Wagoner, Jr., each for a three year term expiring in 2017. As previously announced, neither Mr. Rex Adams nor Sir John Banham has been nominated for re-election to the Board because each has reached the mandatory retirement age. This proposal requires the affirmative vote of a majority of votes cast at the Annual General Meeting. Immediately below is information regarding the directors standing for election and Board members continuing in office.

| Name | Age | Director Since | Occupation | Independent | Other Public Boards | Committee Memberships | ||||||||||||

| A | C | NCG | ||||||||||||||||

Directors standing for election

| Denis Kessler | 62 | 2002 | Chairman and CEO, SCOR SE | X | 2(a) | M | M | M | |||||||||

| G. Richard Wagoner, Jr. | 61 | 2013 | Former Chairman and CEO, General Motors Corporation | X | 1 | M | M | M | ||||||||||

Directors continuing in office | Joseph R. Canion | 69 | 1997 | Former CEO, Compaq Computer Corporation; Former Chairman Insource Technology Group | X | 1 | — | — | Ch(b) | |||||||||

| Martin L. Flanagan | 53 | 2005 | President and CEO, Invesco Ltd. | — | 0 | — | — | — | ||||||||||

| C. Robert Henrikson | 66 | 2012 | Former President and CEO, MetLife, Inc. and Metropolitan Life Insurance Company | X | 1 | M | Ch(b) | M | ||||||||||

| Ben F. Johnson III | 70 | 2009 | Former Managing Partner, Alston & Bird LLP | X | 0 | M | M | M | ||||||||||

| Edward P. Lawrence | 72 | 2004 | Former Partner, Ropes & Gray LLP | X | 0 | M | M | M | ||||||||||

| J. Thomas Presby | 74 | 2005 | Former Partner, Deloitte & Touche LLP | X | 3 | Ch | — | M | ||||||||||

| Phoebe A. Wood | 60 | 2010 | Principal, CompaniesWood, Former Vice Chairman and CFO, Brown-Forman Corporation | X | 3 | M | M | M | ||||||||||

Retiring Directors | Rex D. Adams | 73 | 2001 | Former Vice President of Administration, Mobil Corporation | X | 1 | — | M | Ch | |||||||||

| Sir John Banham | 73 | 1999 | Former Chairman of Johnson Mathey plc | X | 1 | M | Ch | M | ||||||||||

| ||||||||||||

Proposal | Board vote recommendation | For more information: | ||||||||||

Proxy Statement Summary (cont’d)

Governance Highlights

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Additional Information Regarding the Annual General Meeting

Please see “General Information Regarding the Annual General Meeting” beginning on page 57 for important additional information regarding the Annual General Meeting.

Proxy Statement

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Invesco Ltd. (“Board” or “Board of Directors”) for the Annual General Meeting to be held on Thursday, May 15, 2014, at 1:00 p.m. Eastern Time. In this Proxy Statement, we may refer to Invesco Ltd. as the “company,” “Invesco,” “we,” “us” or “our.”

Amendment to the Company’s Amended and RestatedBye-Laws to Declassify our Board

The Board of Directors has unanimously adopted and is submitting for shareholder approval an amendment (the “Amendment”) to the Bye-Laws that would phase in the declassification of our Board of Directors and provide instead for the annual election of directors.

The Board believes that its classified structure has helped assure continuity of the company’s business strategies and has reinforced a commitment to long-term shareholder value. Although these are important benefits, the Board recognized the growing sentiment among shareholders and the investment community in favor of annual elections. After careful consideration, the Board determined that it is appropriate to propose declassifying the Board.

Currently, our Board of Directors is divided into three classes and members of the Board are elected for staggered terms of three years. If the Amendment is approved, commencing with the class of directors standing for election at the 2015 Annual General Meeting, directors will stand for election for a one-year term, expiring at the next succeeding annual general meeting. The directors who were elected at the 2013 Annual General Meeting, whose terms will expire in 2016, and the directors who are elected at the 2014 Annual General Meeting under Proposal No. 2, whose terms will expire in 2017, will continue to hold office until the end of the terms for which they were recently elected. Therefore, if the Amendment is approved all directors will be elected on an annual basis beginning with the 2017 Annual General Meeting. The shaded blocks in the table below illustrates the years in which members of our Board would stand for annual elections if the proposal is approved by our shareholders.

| Election Year | |||||||||

| Director | 2015 | 2016 | 2017 | ||||||

Flanagan, Henrikson, Johnson | |||||||||

Canion, Wood | |||||||||

Kessler, Wagoner | |||||||||

In all cases, each director will hold office until his or her successor has been elected and qualified or until the director’s earlier resignation or removal. If the Amendment is not approved, the Board of Directors will remain classified. Appendix A shows the proposed changes to Bye-Laws 8, 11 and 12, with deletions indicated by strikeouts and additions indicated by underlining.

Recommendation of the Board

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE APPROVAL OF THE AMENDMENT TO THE BYE-LAWS. This proposal requires the affirmative vote of at least 75% of the issued and outstanding shares of the company. Abstentions will have the same effect as votes “against” the proposal.

Election of Directors

FOR

See further below in this summary and pages 6 through 11 for information on the nominees

2

Advisory Vote to Approve the Company’s Executive Compensation

FOR

See page 59 for details

3

Advisory Vote on the Frequency of Future Advisory Votes on the Company’s Executive Compensation

FOR EVERY 1 YEAR

See page 60 for details

4

Amendment of Company’s Second Amended and RestatedBye-Laws to Implement Proxy Access and Other Matters

FOR

See page 61 for details

5

Appointment of PricewaterhouseCoopers LLP for 2017

FOR

See page 66 for details

2

| Election of directors | ||||||||||||||||||||||||||||||||||||||

You are being asked to cast votes for eight directors, Messrs. Joseph R. Canion, Martin L. Flanagan, C. Robert Henrikson, Ben F. Johnson III, Denis Kessler, Sir Nigel Sheinwald, G. Richard Wagoner, Jr. and Ms. Phoebe A. Wood, each for aone-year term expiring in 2018. This proposal requires for each person the affirmative vote of a majority of votes cast at the Annual General Meeting. Immediately below is information regarding directors standing for election.

| ||||||||||||||||||||||||||||||||||||||

| Key: I – Independent A – Audit C – Compensation NCG – Nomination and Corporate Governance M – Member Ch – Chairperson | ||||||||||||||||||||||||||||||||||||||

Director qualifications | ||||||||||||||||||||||||||||||||||||||

Name

| Age

| Director since

| Other public boards

| Committee memberships

A C NCG

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||

|

Joseph R. Canion, (I) Former CEO, Compaq Computer Corporation; Former Chairman Insource Technology Group

| 72 | 1997 | 0 | – | – | Ch | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | |||||||||||||||||||||||||

Martin L. Flanagan, President and CEO, Invesco Ltd.

| 56 | 2005 | 0 | – | – | – | ∎ | ∎ | ∎ | ∎ | ∎ | |||||||||||||||||||||||||||

C. Robert Henrikson, (I) Former President and CEO, MetLife, Inc. and Metropolitan Life Insurance Company

| 69 | 2012 | 1 | M | Ch | M | ∎ | ∎ | ∎ | ∎ | ∎ | |||||||||||||||||||||||||||

Ben F. Johnson III, (I) Former Managing Partner, Alston & Bird LLP Chairperson, Invesco Ltd.

| 73 | 2009 | 0 | M | M | M | ∎ | ∎ | ||||||||||||||||||||||||||||||

Denis Kessler, (I) Chairman and CEO, SCOR SE

| 65 | 2002 | 2 | M | M | M | ∎ | ∎ | ∎ | ∎ | ∎ | |||||||||||||||||||||||||||

Sir Nigel Sheinwald, (I) Former Senior Diplomat, Her Majesty’s Diplomatic Service

| 63 | 2015 | 1 | M | M | M | ∎ | ∎ | ∎ | |||||||||||||||||||||||||||||

G. Richard Wagoner, Jr., (I) Former Chairman and CEO, General Motors Corporation

| 64 | 2013 | 1 | M | M | M | ∎ | ∎ | ∎ | ∎ | ∎ | |||||||||||||||||||||||||||

Phoebe A. Wood, (I) Principal, Companies Wood, Former Vice Chairman and CFO, Brown-Forman Corporation

| 63 | 2010 | 2 | Ch | M | M | ∎ | ∎ | ∎ | ∎ | ||||||||||||||||||||||||||||

| Edward P. Lawrence, (I) Former Partner, Ropes & Gray LLP | 75 | 2004 | 0 | M | M | M | ∎ | ∎ | ∎ | ∎ | |||||||||||||||||||||||||||

Mr. Lawrence has not been nominated for re-election to the Board because he has reached the mandatory retirement age.

| ||||||||||||||||||||||||||||||||||||||

The table above highlights certain skills, knowledge or experiences of our directors. The Board believes that all of the directors are highly qualified. As the table above and biographies below show, the directors have the significant leadership and professional experience, knowledge and skills necessary to provide effective oversight and guidance for Invesco’s global strategy and operations. As a group, they represent diverse views, experiences and backgrounds. All the directors satisfy the criteria set forth in our Corporate Governance Guidelines and possess the characteristics that are essential for the proper functioning of our Board. | ||||||||||||||||||||||||||||||||||||||

3

Governance highlights |

| Independence | – | 8 of our 9 directors are independent. | ||||||

| – | Our chief executive officer is the only management director. | |||||||

| – | All of our Board committees are composed exclusively of independent directors. | |||||||

| Independent Chairperson | – | We have an independent Chairperson of our Board of Directors, selected by the independent directors. | ||||||

| – | The Chairperson serves as liaison between management and the other independent directors. | |||||||

| Executive sessions | – | The independent directors regularly meet in private without management. | ||||||

| – | The Chairperson presides at these executive sessions. | |||||||

| Board oversight of risk management | – | Our Board has principal responsibility for oversight of the company’s risk management process and understanding of the overall risk profile of the company. | ||||||

| Share ownership requirements | – | Our non-executive directors must hold at least 18,000 shares of Invesco common stock within seven years of joining the Board. | ||||||

| – | Our chief executive officer must hold at least 250,000 shares of Invesco common stock. | |||||||

| – | All other executive officers must hold at least 100,000 shares of Invesco common stock. | |||||||

| Board practices | – | Our Board annually reviews its effectiveness as a group with a questionnaire and confidential and private one-on-one interviews coordinated by an independent external advisor specializing in corporate governance that reports results of the annual review in person to the Board. | ||||||

| – | Nomination criteria are adjusted as needed to ensure that our Board as a whole continues to reflect the appropriate mix of skills and experience. | |||||||

| – | Directors may not stand for election after age 75. | |||||||

| Accountability | – | Directors are elected for one-year terms and must be elected by a majority of votes cast. | ||||||

| – | A meeting of shareholders may be called by shareholders representing 10% of our outstanding shares. |

4

| Proxy Statement | ||

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Invesco Ltd. (“Board” or “Board of Directors”) for the Annual General Meeting to be held on Thursday, May 11, 2017, at 1:00 p.m. Central Time. Please review the entire Proxy Statement and the company’s 2016 Annual Report on Form10-K before voting. In this Proxy Statement, we may refer to Invesco Ltd. as the “company,” “Invesco,” “we,” “us” or “our.” | ||

The Board

| ||

The Board has nominated Messrs. Joseph R. Canion, Martin L. Flanagan, C. Robert Henrikson, Ben F. Johnson III, Denis Kessler, | ||

Further information regarding | ||

Under ourBye-Laws, at any general meeting held for the purpose of electing directors at which a quorum is present, each director nominee receiving a majority of the votes cast at the meeting will be elected as a director. If a nominee for director who is an incumbent director is not elected and no successor has been elected at the meeting, the director is required under ourBye-Laws to submit his or her resignation as a director. Our Nomination and Corporate Governance Committee would then make a recommendation to the full Board on whether to accept or reject the resignation. If the resignation is not accepted by the Board, the director will continue to serve until the next annual general meeting and until his or her successor is duly elected, or his or her earlier resignation or removal. If the director’s resignation is accepted by the Board, then the Board may fill the vacancy. However, if the number of nominees exceeds the number of positions available for the election of directors, the directors so elected shall be those nominees who have received the greatest number of affirmative votes and at least | ||

| Recommendation of the board | ||

| THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE |

Former public company CEO, global business experience: Mr. Canion has notable experience as an entrepreneur, having co-founded a business that grew into a major international technology company. We believe that his experience guiding a company throughout its business lifecycle has given him a wide-ranging understanding of the types of issues faced by public companies. Relevant industry experience: Mr. Canion has extensive service as a board member within the investment management industry, having also served as a director of AIM Investments, a leading U.S. mutual fund manager, from 1993 through 1997 when Invesco acquired AIM. ∎ ∎ ∎ Information technology industry experience: Mr. Canion has been involved in the technology industry since co-founding Compaq Computer Corporation and founding Insource Technology Group.

Non-Executive Director Director since 2002 Committees: Audit, Compensation, Nomination and Corporate Governance

Denis Kessler (62) has served as

Martin L. Flanagan Director, President and Age 56 Director since 2005 | Martin L. Flanagan, CFA & CPA Martin Flanagan has been a | |

Director qualifications: |

| ∎ | Public company CEO, relevant industry experience: Mr. Flanagan has spent over 30 years in the investment management industry, including roles as an investment professional and a series of executive management positions in business integration, strategic planning, investment operations, shareholder services and finance, with over eleven years spent as a chief executive officer. Through his decades of involvement, including as former chairperson of our industry’s principal trade association, the Investment Company Institute, he has amassed a broad understanding of the larger context of

|

| ∎ | Financial and accounting expertise: Mr. Flanagan obtained extensive financial accounting experience with a major international accounting firm and serving as chief financial officer of Franklin Resources. He is a chartered financial analyst and certified public accountant. |

C. Robert Henrikson Non-Executive Director Age 69 Director since 2012 | C. Robert Henrikson Robert Henrikson has served as anon-executive director of our company since 2012. Mr. Henrikson was president and chief executive officer of MetLife, Inc. and Metropolitan Life Insurance Company from March 2006 through May 2011, and he served as a director of MetLife, Inc. from April 2005, and as chairman from April 2006 through December 31, 2011. During his more than39-year career with MetLife, Inc., Mr. Henrikson held a number of senior positions in that company’s individual, group and pension businesses. Mr. Henrikson is a former chairman of the American Council of Life Insurers, a former chairman of the Financial Services Forum, a director emeritus of the American Benefits Council and a former member of the President’s Export Council. Mr. Henrikson also serves as chairman of the board of the S.S. Huebner Foundation for Insurance Education, as a member of the boards of trustees of Emory University and Indian Springs School and a member of the board of directors of Americares. Mr. Henrikson earned a bachelor’s degree from the University of Pennsylvania and a J.D. degree from Emory University School of Law. In addition, he is a graduate of the Wharton School’s Advanced Management Program. Board committees Audit, Compensation (chairperson) and Nomination and Corporate Governance Director qualifications |

| ∎ | Former public company CEO, relevant industry experience: Mr. Henrikson’s more than 39 years of experience in the financial services industry, which includes diverse positions of increasing responsibility leading to his role as chief executive officer of MetLife, Inc., have provided him with anin-depth understanding of our industry. | |

| ∎ | Public company board experience: Mr. Henrikson currently serves on the Board of Directors of Swiss Re (chair of the compensation committee, member of the chairman’s and governance committee and the finance and risk committee). Until 2011, Mr. Henrikson served as the chairperson of the board of MetLife, Inc. | |

Ben F. Johnson III Chairperson and Non-Executive Director | Ben F. Johnson III Ben Johnson has served as Chairperson of our company since 2014 and as anon-executive director of our company since January 2009. Mr. Johnson served as the managing partner at Alston & Bird LLP from 1997 to 2008. He was named a partner at Alston & Bird in 1976, having joined the firm in 1971. He earned his B.A. degree from Emory University and his J.D. degree from Harvard Law School. Board committees Audit, Compensation and Nomination and Corporate Governance | |

Age 73 Director since 2009 | Director qualifications: |

| ∎ | Executive leadership, corporate governance, legal expertise: Mr. Johnson possesses more than a decade of experience leading one of the largest law firms in Atlanta, Georgia, where Invesco was founded and grew to prominence. His more than30-year career as one of the region’s leading business litigators has given Mr. Johnson deep experience of the types of business and legal issues that are regularly faced by large public companies such as Invesco. | |

| ∎ | Civic and private company board leadership: Mr. Johnson serves on the Executive Committee of the Atlanta Symphony Orchestra and as a Trustee of The Carter Center and the Charles Loridans Foundation. Mr. Johnson is Chair Emeritus of Atlanta’s Woodward Academy, having served as Chair from 1983 to 2016, and served as Chair of the Board of Trustees of Emory University from 2000-2013. He is also Chair and anon-executive director of Summit Industries, Inc., a privately-held company. | |

Director

Denis Kessler Non-Executive Director Age 65 Director since 2002 | Denis Kessler Denis Kessler has served as anon-executive director of our company since 2002. Mr. Kessler is chairman and chief executive officer of SCOR SE. Prior to joining SCOR, Mr. Kessler was chairman of the French Insurance Federation, senior executive vice president of the AXA Group and executive vice chairman of the French Business Confederation. Mr. Kessler is a graduate from École des Hautes Études Commerciales (HEC Paris). He holds a Doctorat d’Etat from the University of Paris and Doctor Honoris Causa from the Moscow Academy of Finance and the University of Montreal. In addition, he is a qualified actuary. Mr. Kessler previously served as a member of the supervisory board of Yam Invest N.V. from 2008 until 2014, a privately-held company, and currently serves as a global counsellor of The Conference Board. While Mr. Kessler is currently the CEO and Chairperson of a public company and serves as an outside director of two public companies (Invesco and BNP Paribas), he has demonstrated a continued commitment to Invesco, which is reflected, in part, by his attendance at all of Invesco’s Board of Director’s meetings and all but one of the Board’s Committees’ meetings during 2016. Mr. Kessler’s unique perspective, fueled by his experience as an economist, his diverse international business experience and current position with a major global reinsurance company, significantly enhances the skill set of our Board of Directors by providing, among other things, valuable insight into both the investment management industry’s macro-economic positioning over the long term as well as our company’s particular challenges within that industry. Also, as a director with 15 years of tenure with Invesco, Mr. Kessler has a deep understanding of our industry and our company. Board committees Audit, Compensation and Nomination and Corporate Governance Director qualifications: |

| ∎ | Public company CEO, relevant industry experience: Mr. Kessler’s experience as an economist and chief executive of a major global reinsurance company have combined to give him valuable insight into both the investment management industry’s macro-economic positioning over the long term as well as our company’s particular challenges within that industry. | |

| ∎ | Global business experience: Mr. Kessler’s experience as a director of a variety of international public companies in several industries enables him to provide effective counsel to our Board on many issues of concern to our management. | |

| ∎ | Public company board experience: Mr. Kessler currently serves on the boards of SCOR SE and BNP Paribas SA (accounts committee (president)). He previously served on the boards of directors of Bollore from 1999 until 2013, Fonds Strategique d’Investissement from 2008 until 2013 and Dassault Aviation from 2003 until 2014. | |

Director since 2013

Committees:

Audit,

Compensation,

Nomination and

Corporate

Governance

G. Richard (“Rick”) Wagoner, Jr. (61) has served as a non-executive director of our company since October 2013. Mr. Wagoner served as chairman and chief executive officer of General Motors Corporation (“GM”) from May 2003 through March 2009, and had been president and chief executive officer since June 2000. Prior positions held at GM during his 32-year career with that company include executive vice president and president of North American operations, executive vice president, chief financial officer and head of worldwide purchasing, and president and managing director of General Motors do Brasil. On June 1, 2009, GM and its affiliates filed voluntary petitions in the United States Bankruptcy Court for the Southern District of New York, seeking relief under Chapter 11 of the U.S. Bankruptcy Code. Mr. Wagoner was not an executive officer or director of GM at the time of that filing. Mr. Wagoner is a member of the board of directors of Graham Holdings Company and several privately-held companies. In addition, he is a member of the advisory boards of AEA Investors and Jefferies Investment Banking and Capital Markets Group, and he advises a number of start-up and early-stage ventures. Mr. Wagoner is a member of the board of visitors of Virginia Commonwealth University, chair of the Duke Kunshan University Advisory Board and a member of Duke’s Fuqua School of Business Advisory Board. He is a member of the mayor of Shanghai, China’s International Business Leaders Advisory Council. Mr. Wagoner received his B.A. from Duke University and his M.B.A. from Harvard University.

Skills and Expertise

Rick Wagoner brings to the Board valuable business, leadership and management insights into driving strategic direction and international operations gained from his32-year career with GM. Mr. Wagoner also brings significant experience in public company financial reporting and corporate governance matters gained through his service with other public companies.

Sir Nigel Sheinwald Non-Executive Director Age 63 Director since 2015 | Sir Nigel Sheinwald Sir Nigel Sheinwald has served as anon-executive director of our company since 2015. Sir Nigel was a senior British diplomat who served as British Ambassador to the United States from 2007 to 2012, before retiring from Her Majesty’s Diplomatic Service. Prior to this, he served as Foreign Policy and Defence Adviser to the Prime Minister from 2003 to 2007. He served as British Ambassador and Permanent Representative to the European Union in Brussels from 2000 to 2003. Sir Nigel joined the Diplomatic Service in 1976 and served in Brussels, Washington, Moscow, and in a wide range of policy roles in London. From 2014 to 2015, Sir Nigel served as the Prime Minister’s Special Envoy on intelligence and law enforcement data sharing. Sir Nigel also serves as anon-executive director of the Innovia Group and Raytheon UK and a senior advisor to the Universal Music Group. He is also a visiting professor and member of the Council at King’s College, London. In addition, Sir Nigel is the Chairperson of theU.S.-U.K. Fulbright Education Commission and serves on the Advisory Boards of the Ditchley Foundation, BritishAmerican Business and the Centre for European Reform. He is an Honorary Bencher of the Middle Temple, one of London’s legal inns of court. Sir Nigel received his M.A. degree from Balliol College, University of Oxford, where he is now an Honorary Fellow. |

Board committees Audit, Compensation and Nomination and Corporate Governance |

Director qualifications: |

∎ |

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

For a director to be considered independent, the Board must affirmatively determine that the director does not have any material relationship with the company either directly or as a partner, shareholder or officer of an organization that has a relationship with the company. Such determinations are made and disclosed according to applicable rules established by the New York Stock Exchange (“NYSE”) or other applicable rules. In accordance with the rules of the NYSE, the Board has affirmatively determined that it is currently composed of a majority of independent directors, and that the following current directors are independent and do not have a material relationship with the company: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Director tenure The tenure of our directors following the 2017 Annual General Meeting will range from two to nineteen years. Our directors contribute a wide range of knowledge, skills and experience as illustrated in their individual biographies. We believe the tenure of the members of our Board of Directors provides the appropriate balance of expertise, experience, continuity and perspective to our board to serve the best interests of our shareholders. We believe providing our Board with new perspectives and ideas is an important component to a well-functioning board. To that end, our Board has undergone a thoughtful and strategic evolution over the past five years with three new directors being added to the board, a new chairperson of the Board and new chairpersons of each of the Board’s standing committees. As the Board considers new director nominees, it takes into account a number of factors, including nominees that have skills that will match the needs of the company’s long-term global strategy and will bring diversity of thought, global perspective, experience and background to our Board. For more information on our director nomination process,see Information about our Board and its Committees – the Nomination and Corporate Governance Committee below. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Corporate The Board has adopted Corporate Governance Guidelines (“Guidelines”) and Terms of Reference for our | ||

Board As described in the Guidelines, the company’s business is conductedday-to-day by its officers, managers and employees, under the direction of the Chief Executive Officer and the oversight of the Board, to serve the interest of our clients and enhance the long-term value of the company for its shareholders. The Board is elected by the shareholders to oversee our management team and to seek to assure that the long-term interests of the shareholders are being served. In light of these differences in the fundamental roles of the Board and management, the company has chosen to separate the Chief Executive Officer and Board | ||

Code of As part of our ethics and compliance program, our Board has approved a code of ethics (the “Code of Conduct”) that applies to our principal executive officer, principal financial officer, principal accounting officer and persons performing similar functions, as well as to our other officers and employees. The Code of Conduct is posted on | ||

Board’s The Board has principal responsibility for oversight of the company’s risk management processes and for understanding the overall risk profile of the company. Though Board committees routinely address specific risks and risk processes within their purview, the Board has not delegated primary risk oversight responsibility to a committee. | ||

| Our risk management framework provides the basis for consistent and meaningful risk dialogue up, down and across the company. Our Global Performance Measurement and Risk |

At each Board meeting, the Board reviews and discusses with senior management information pertaining to risk provided by the Global Performance Measurement and Risk Group and the Corporate Risk Management Committee. |

| |||||||

At each Board meeting, the Board reviews and discusses with senior management information pertaining to risk provided by the Global Performance Measurement and Risk

| ||||||||

In addition, the Compensation Committee | ||||||||

Invesco’s compensation programs are designed to reward success over the long-term, promote a longer term view of risk and return in decision making and protect against incentives for

| ||||||||

| ∎ | The Compensation Committee | |||||||

| ∎ | The vast majority of investment professional bonus plans have multi-year measurement periods, caps on earnings and | |||||||

| ∎ | Sales and commission plans generally contain multiple performance measures and discretionary elements; and | |||||||

| ∎ | Executives receive a substantial portion of compensation in the form of long-term equity that | |||||||

The Audit Committee routinely receives reports from the control functions of finance, legal, | ||||

| The Board annually reviews its own performance. | Board’s annual performance evaluation As part of its annual performance evaluation of the Board and each of its committees, the Board engages an independent external advisor specializing in corporate governance to coordinate the Board’s self assessment by its members. The advisor has each director complete a questionnaire and then performsone-on-one interviews with directors and prepares a report for the Board’s review. The advisor presents the report in person to the Board, and the Board discusses the evaluation to determine what action, if any, could further enhance the operations of the Board and its committees. In addition to the questionnaire and confidential and private interviews of each director, interviews are also conducted with those members of senior management who attend Board meetings on a regular basis. | |||

| Invesco recognizes our responsibility to help sustain a healthy, clean environment for future generations. | Investment and corporate stewardship - environmental, social and governance responsibility As a global investment management organization, Invesco is committed to adopting and implementing responsible investment principles in a manner that is consistent with our fiduciary responsibilities to clients. Invesco recognizes the importance of considering environmental, social and governance (ESG) issues as part of a robust investment process. Additionally, Invesco’s corporate stewardship programs focus on human capital development and our responsibility to help sustain a healthy, clean environment for future generations. We are committed to fostering greater transparency and continuous improvement with regard to investment and corporate stewardship within our business. Below are some of the actions Invesco is taking to meet these stewardship commitments. | |||

∎ | In June 2013, Invesco became a signatory to the United Nations Principles for Responsible Investment (PRI), which is the leading global responsible investment network of investment managers. Invesco’s most recent annual rating from PRI on Proxy Voting and Governance is an “A.” Invesco’s PRI transparency report is publicly available at www.unpri.org. Invesco is also a signatory to the UK Stewardship Code and Japan Stewardship Code, which, like PRI, promote active engagement in corporate governance. Additional information about Invesco’s commitment to Principles for Responsible Investment is available under the About Us tab on the company’s website. | |||

∎ | Our company is a constituent of the FTSE4Good Index Series, which seeks to help investors identify organizations with good track records of corporate social responsibility. | |||

∎ | Invesco believes the voting of proxies should be managed with the same care as all other elements of the investment process. The proxy voting process at Invesco, which is driven by investment professionals, focuses on maximizing long-term value for our clients, protecting clients’ rights and promoting governance structures and practices that reinforce the accountability of corporate management and boards of directors to shareholders. Invesco’s Policy Statement on Global Corporate Governance and Proxy Voting is also available under the About Us tab on the company’s website. | |||

∎ | The Invesco Environmental Steering Committee, which includes executive management representation, oversees and drives the company’s global environmental policy. The committee monitors environmental impacts, gathers ideas and suggestions for improving our global environmental management, and approves initiatives that drive our regional management processes to align with our global environmental policies. | |||

∎ | Invesco ranked #1 out of 10 companies in the U.S. capital markets industry and #9 out of 93 companies in the financial sector in the 2016 Newsweek Green Rankings, which assessed the corporate environmental performance of the world’s largest publicly traded companies. | |||

| ∎ | Invesco has also made significant progress in reducing our impact on the environment at a number of our global locations. Our Atlanta, Dublin, Frankfurt, Henley, Houston, Hyderabad, London, New York, Prince Edward Island and Toronto locations, which comprise approximately 80% of Invesco’s employees around the world, are ISO 14001 registered - a certification that Invesco has the framework in place to effectively manage its environmental responsibilities. | |||

| ∎ | Invesco has received certification in the Leadership in Energy and Environmental Design (LEED) program. Our Hyderabad office achieved the highest platinum standard, while our New York office achieved the gold standard and our Atlanta headquarters and Houston office achieved the silver standard. LEED certification is globally recognized as the premier mark of achievement in green building. | |||

| ∎ | Invesco participates in the Carbon Disclosure Project, reporting on carbon emissions and reduction management processes, and our commitment to sound environmental practices is summarized in our Global Environmental Policy Statement found under the About Us tab on the company’s website. | |||

| ∎ | Invesco values our employees and their diverse perspectives. Our company provides equal opportunity in its employment and promotion practices and encourages employees to play active roles in the growth and development of the communities in which they live and work. Invesco conducts regular employee surveys to monitor employee satisfaction with results showing consistently high levels of employee engagement driven by many positive factors including employees’ perspectives regarding ethics and values at the company, the company’s strategy and direction, and opportunity for personal development. Furthermore, our employee engagement scores exceed the “global high performing organizations” norm, a relevant benchmark provided by our employee survey provider, Willis Towers Watson. | |||

| ∎ | Employees are compensated with a meaningful mix of total rewards to help plan for retirement, stay healthy and maintain a work-life balance. These rewards include: | |||

| – | Comprehensive health and wellness programs | |||

| – | Retirement savings plans | |||

| – | Life insurance plans and income-protection benefits | |||

| – | Holiday andtime-off benefits | |||

| – | Flexibility to help balance work and family responsibilities | |||

| – | Rich opportunities to develop professional skills and knowledge | |||

| – | Opportunities to contribute to their community | |||

| – | Opportunities to become an Invesco shareholder through our employee | |||

| stock purchase plan | ||||

| The following table shows as of December 31, |

| ||||||||||||

| Name | Year service commenced | Total shares held (#) | Share ownership goal met2 | |||||||||

| ||||||||||||

Joseph R. Canion | 1997 | 48,7471 | ✓ | |||||||||

| ||||||||||||

C. Robert Henrikson | 2012 | 18,703 | ✓ | |||||||||

| ||||||||||||

Ben F. Johnson III | 2009 | 31,615 | ✓ | |||||||||

| ||||||||||||

Denis Kessler | 2002 | 42,969 | ✓ | |||||||||

| ||||||||||||

Edward P. Lawrence | 2004 | 34,518 | ✓ | |||||||||

| ||||||||||||

Sir Nigel Sheinwald | 2015 | 6,452 | ||||||||||

| ||||||||||||

G. Richard Wagoner, Jr. | 2013 | 17,354 | ||||||||||

| ||||||||||||

Phoebe A. Wood

|

| 2010

|

|

| 22,986

|

|

| ✓

|

| |||

| ||||||||||||

1 Includes deferred shares awarded under our legacy Deferred Fees Share Plan. |

| |||||||||||

2 Based on current compensation levels, it is anticipated that Sir Nigel and Mr. Wagoner will each attain the share ownership goal within the time period prescribed by the policy.

|

| |||||||||||

| ||||||||||||

| Director compensation table for 2016 | ||||||||||||

The following table sets forth the compensation paid to ournon-executive directors for services during 2016.

|

| |||||||||||

| ||||||||||||

| Name | Fees earned or paid in cash ($)1 | Share awards ($)2 | Total ($) | |||||||||

| ||||||||||||

Joseph R. Canion | 135,000 | 144,953 | 279,953 | |||||||||

| ||||||||||||

C. Robert Henrikson | 135,000 | 144,953 | 279,953 | |||||||||

| ||||||||||||

Ben F. Johnson III | 400,000 | 144,953 | 544,953 | |||||||||

| ||||||||||||

Denis Kessler | 120,000 | 144,953 | 264,953 | |||||||||

| ||||||||||||

Edward P. Lawrence | 120,000 | 144,953 | 264,953 | |||||||||

| ||||||||||||

| ||||||||||||

Sir Nigel Sheinwald | 120,000 | 144,953 | 264,953 | |||||||||

| ||||||||||||

G. Richard Wagoner, Jr. | 120,000 | 144,953 | 264,953 | |||||||||

| ||||||||||||

Phoebe A. Wood |

| 170,000

|

|

| 144,953

|

|

| 314,953

|

| |||

| ||||||||||||

1 Includes the annual basic cash fee and, as applicable, chairperson of the Board fee and committee chairperson fees. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The following table presents the grant date fair value for each share award made to eachnon-executive director during 2016.

| ||||||||||

| ||||||||||

| Name | Date of grant 1/29/16 ($) | Date of grant 4/29/16 ($) | Date of grant 7/29/16 ($) | Date of grant 10/28/16 ($) | Total grant date fair value ($) | |||||

| ||||||||||

Joseph R. Canion | 36,245 | 36,220 | 36,242 | 36,246 | 144,953 | |||||

| ||||||||||

C. Robert Henrikson | 36,245 | 36,220 | 36,242 | 36,246 | 144,953 | |||||

| ||||||||||

Ben F. Johnson III | 36,245 | 36,220 | 36,242 | 36,246 | 144,953 | |||||

| ||||||||||

Denis Kessler | 36,245 | 36,220 | 36,242 | 36,246 | 144,953 | |||||

| ||||||||||

Edward P. Lawrence | 36,245 | 36,220 | 36,242 | 36,246 | 144,953 | |||||

| ||||||||||

Sir Nigel Sheinwald | 36,245 | 36,220 | 36,242 | 36,246 | 144,953 | |||||

| ||||||||||

G. Richard Wagoner, Jr. | 36,245 | 36,220 | 36,242 | 36,246 | 144,953 | |||||

| ||||||||||

Phoebe A. Wood | 36,245

| 36,220

| 36,242

| 36,246

| 144,953

| |||||

| ||||||||||

The aggregate number of share awards outstanding as of December 31, |

| ||||||||||||

| Name | Shares outstanding (#) | Deferred shares outstanding (#) | Total share awards outstanding (#) | |||||||||

| ||||||||||||

Joseph R. Canion1 | 41,822 | 5,925 | 47,747 | |||||||||

| ||||||||||||

C. Robert Henrikson | 18,375 | 18,375 | ||||||||||

| ||||||||||||

Ben F. Johnson III | 29,615 | 29,615 | ||||||||||

| ||||||||||||

Denis Kessler | 41,869 | 41,869 | ||||||||||

| ||||||||||||

Edward P. Lawrence | 34,518 | 34,518 | ||||||||||

| ||||||||||||

Sir Nigel Sheinwald | 6,452 | 6,452 | ||||||||||

| ||||||||||||

G. Richard Wagoner, Jr. | 12,354 | 12,354 | ||||||||||

| ||||||||||||

Phoebe A. Wood2 |

| 22,986

|

|

| 22,986

|

| ||||||

| ||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

About the Executive Officers of the Company | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

In addition to Martin L. Flanagan, whose information is set forth above, the following is a list of individuals serving as executive officers of the company as of the date of this Proxy Statement. All company executive officers are elected annually by the Board and serve at the discretion of the Board or our Chief Executive Officer.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Compensation

This section presents a discussion and analysis of the philosophy and objectives of our Board’s Compensation Committee (the “committee”) in designing and implementing compensation programs for our executive officers. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The presentation has two main sections – an executive summary and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

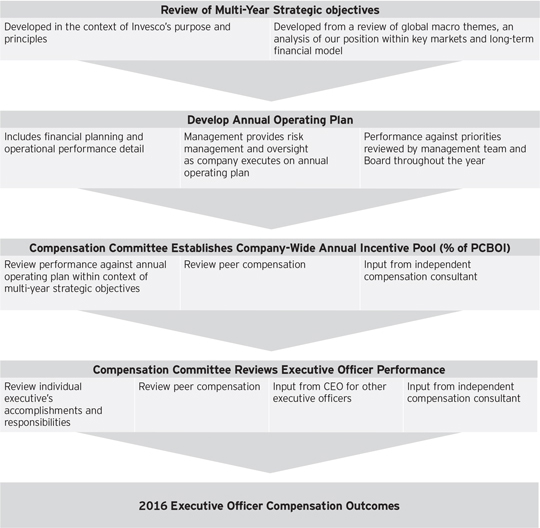

| The balance of the presentation has three components. We provide a morein-depth discussion of our compensation philosophy, design and process, including the components of executive compensation and their respective purposes. We then provide a flowchart of our 2016 compensation decision-making process and discuss each element of the flowchartin-depth – including matters we briefly described in the executive summary. We next present detailed review of the 2016 accomplishments and compensation determinations |

2016 Named executive officers

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Martin L. Flanagan President and Chief Executive | Loren M. Starr

Director and Chief Financial Officer | Andrew T.S. Lo Senior Managing Director and Head of Asia Pacific | Colin D. Meadows Senior Managing Director and Chief Administrative Officer

Our 2016 highlights | In spite of challenging market conditions, Invesco continued to execute well against our strategic objectives described below, which enabled us to deliver strong, long-term investment performance to clients and further advance our competitive position. At the same time, our financial performance for 2016 was lower year-over-year, reflecting volatile markets, numerous headwinds in the operating environment of many markets we serve and efforts to invest in our business for the long term. After a review of the company’s financial performance, our committee decided that the company-wide incentive pool should be reduced for 2016. In addition, as part of its rigorous and judicious executive compensation decision-making, our committee determined that our chief executive officer’s total incentive compensation should be reduced by approximately 11%. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

2016 Financial performance (year-over-year change)

| ||||||||

Annual Adjusted Operating Income1 | Annual Adjusted Operating Margin1 | Annual Adjusted Diluted EPS1 | Return of Capital to Shareholders2 | Long-Term Organic Growth Rate3 | ||||

| $ 1.3 Billion | 38.7% | $2.23 | $995 Million | 1.9% | ||||

| (-12.1%) | (-2.3 percentage points) | (-8.6%) | (-0.8%) | (-0.5 percentage points) | ||||

1 The adjusted financial measures are allnon-GAAP financial measures. See the information in Appendix B of this Proxy Statement regardingNon-GAAP financial measures. | ||||||||||

2 Return of capital to shareholders is calculated as dividends paid plus share repurchases during the year ended December 31, 2016. | ||||||||||

3 Annualized long-term organic growth rate is calculated using long-term net flows divided by opening long-term AUM for the period. Long-term AUM excludes institutional money market AUM and PowerShares QQQ AUM. | ||||||||||

We continued to successfully execute our strategic objectives for the benefit of clients and shareholders | ||||||||||

We focus on | ||||||||||

| Our strategic objectives | 2016 Achievements – A strong focus on delivering better outcomes to clients | |||||||||||

| Achieve strong investment performance | Percent of our | |||||||||||

| ||||||||||||

– Further strengthened our investment culture, which enabled us to

| ||||||||||||

Be instrumental to our clients’ success | – Continued to expand our solutions team, which | |||||||||||

– Successfully launched our global key account initiative and further coordinated client engagement across regions to enhance our clients’ investment experience. | ||||||||||||

– Invested in our institutional business by further refining our global strategy, strengthening the team with experienced talent and more effectively aligning the firm’s efforts to opportunities in the market. We saw early successes from this work, with strong institutional flows in the third and fourth quarters of 2016. | ||||||||||||

Harness the power of our global platform | – Completed the acquisition of Jemstep, a market-leading provider of advisor-focused digital solutions. The acquisition represents an investment in our partnership with the advisor community and highlights our efforts to participate in the technology evolution within our industry. | |||||||||||

– Enhanced our social responsibility efforts by publicly communicating our perspective on environmental, social and governance issues; published our first Global Investment Stewardship Report in early 2017. | ||||||||||||

Perpetuate a high- performance organization | – Further strengthened our investment and distribution teams through new hires and our efforts to attract, develop, motivate and retain the best talent in the industry. | |||||||||||

– Initiated our business optimization program, which delivered | ||||||||||||

25

| Enhancements to our executive compensation program | ||

At the 2016 Annual General Meeting of Shareholders, 79.7% of the votes cast were in favor of the advisory proposal to approve our named executive officer compensation. As described below, the committee made enhancements to the executive compensation program last year in response to shareholder feedback received in 2015 and early 2016 and the committee’s review of the compensation market. During the fall and winter of 2016, we again sought feedback on our compensation programs from our largest shareholders. The shareholders who recently provided feedback did not voice any concerns regarding our named executive officer compensation and positively acknowledged our recent changes. Based on these responses, no additional changes were made to our compensation program this year. | ||

| Long-term performance-based equity awards granted in 2017 in respect of 2016 aresubject to a multi-year performance period.Based on feedback from shareholders, we have transitioned the performance period for our |

| Long-term equity awards granted in 2017 in respect of 2016 vest subject to theachievement of adjusted operating margin, as opposed to achievement of either adjustedoperating margin or adjusted earnings per share thresholds in prior years.A focus on adjusted operating margin ensures discipline in corporate investments, initiatives and capital allocation. It is a measure of overall strength of the business and, importantly, we believe it more effectively avoids conflicts of interest with clients than other measures could introduce. |

| Performance objectives are applied to performance-based awards granted in 2017in respect of 2016.The committee made this enhancement last year in tandem with introducing a multi-year performance period to performance-based awards. We believe this further strengthens alignment of our executive officers’ compensation with client interests and shareholder success. See Our variable incentive compensation – Our long-term equity awards below for additional details. | |

Invesco’s executive compensation outcomes are based on operating results within the context of multi-year strategic objectives. | Determination of company-wide annual incentive pool based upon progress against | |

Throughout the year, the committee examines our performance against the factors listed below inOur multi-year strategic objectives and annual operating plan. Based on the company’s

Officers – Determination of company-wide incentive pool based upon progress against strategic objectives and annual operating plan below. Consistent with past practice, all 2016 incentive awards, including NEO awards, were paid out of this incentive pool. Our compensation | ||

| Mr. Flanagan’s total | Chief executive officer compensation | |

| incentive compensation was reduced by approximately 11%. | Martin L. Flanagan led the company’s efforts to deliver better outcomes and |

26

2016 Performance metrics (year-over-year change)

| ||||||||||

Annual adjusted operating income1

| Annual adjusted operating margin1

| Annual adjusted diluted EPS1

| Return of capital to shareholders2

| Long-Term Organic Growth Rate3

| ||||||

| $1.3 Billion | 38.7% | $2.23 | $995 Million | 1.9% | ||||||

| (-12.1%) | (-2.3 percentage points) | (-8.6%) | (-0.8%) | (-0.5 percentage points) | ||||||